By M. Blanga-Gubbay[1] Université Libre de Bruxelles (ECARES) and University of Zurich (Kühne Center) and M. Hennicke Université Libre de Bruxelles (ECARES) and Université de Cergy-Pontoise

Recent trade agreements have moved beyond tariff reductions, encompassing provisions and obligations related to non-tariff issues. These aspects are often seen as the reflection of interest groups, able to manipulate and extract additional rents from the ratification of these agreements. We provide empirical evidence that corporate lobbying on trade agreements matters for corporate profits. We use the historical shock to U.S. trade policy – the non-ratification of the Trans-Pacific Partnership (TPP) – following the unexpected victory of Donald Trump in the 2016 U.S. presidential election. We find that stock prices of companies that lobbied in favour of the TPP underperformed following the election. On the intensive margin, we find a strong and positive relationship between the amount spent in lobbying and the cumulative losses of lobbying firms. Finally, by comparing the original TPP agreement with its newer version (CPTPP) without U.S. participation, we provide evidence that firms’ lobbying activity was related to having some specific provisions included in the agreement.

A major trend has characterized international trade in recent decades: the proliferation of regional and free trade agreements (RTAs / FTAs). There are currently more than 300 RTAs in force, with many more being negotiated. RTAs have not only risen in number but have also become “deeper” over time, often encompassing provisions that go beyond traditional trade policy, such as rules on investment and intellectual property rights. Rodrik (2018) argues that deep trade agreements are “the result of rent-seeking, self-interested behaviour on the part of politically well-connected firms – international banks, pharmaceutical companies, multinational firms.” Concerns about the influence of powerful multinational corporations have also stirred strong public opposition to recent multilateral trade agreements such as the Transatlantic Trade and Investment Partnership (TTIP) and the Trans-Pacific Partnership (TPP).

We study the effects of a unique protectionist shock to U.S. trade policies. We exploit Trump’s strong opposition to the TPP agreement during the presidential campaign, combined with his unexpected victory at the 2016 U.S. presidential election, and provide empirical evidence that corporate lobbying on trade agreements matters for corporate expected profits.

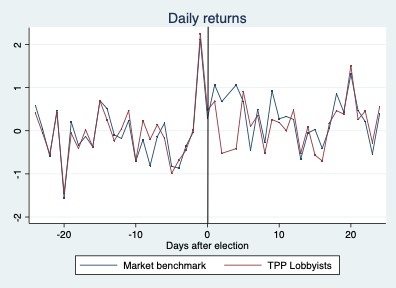

First, using detailed information from lobbying reports available under the Lobbying Disclosure Act of 1995, we construct an original dataset that allows us to trace firms’ lobbying expenditures on the TPP agreement negotiated by the United States. The reports provide information on the identity of the firm, how much it spent, and whether it supported or opposed the FTA. We first uncover that virtually all firms that lobby supported the TPP, confirming a result from Blanga-Gubbay et al. (2018). We then match our lobbying database with firms’ returns in the US stock market. We find that stock prices of companies that lobbied in favour of the TPP underperformed following the election. Lobbying firms displayed four consecutive days of negative returns following Trump’s election, compared to the market benchmark that remained positive over the same period.

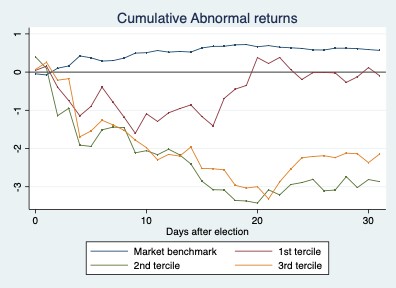

Analysing the cumulative impact of the shock, we show that this negative effect was persistent, lasting more than 5 weeks (30 working days). Moreover, on the intensive margin, we find a strong and positive relationship between the amount spent in lobbying and the cumulative losses of lobbying firms in the US stock market. We divide lobbying firms in three different categories, according to the total lobbying expenditure in favour of the ratification of the TPP agreement. Firms in the first tercile of the lobbying expenditure distribution – firms that spent less lobbying on TPP – experience the smaller losses, and recover quickly from the shock: after 20 days the cumulative abnormal returns are again positive. Firms in the second and third terciles of the lobbying expenditure distribution are the ones driving the effect, showing the strong correlation between lobbying expenditure and market losses.

Finally, we provide evidence of the determinants of corporate lobbying. Following the withdrawal of the U.S. from the TPP agreement the remaining 11 countries signed a new multilateral agreement, the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). We exploit the differences between the two agreements, and more specifically we look at the twenty-two items and provisions included in the original TPP that have been suspended under CPTPP. These items are most likely expression of U.S. firms’ interests, given that the 11 remaining countries unanimously suspended them as soon as the U.S. withdrew from the agreement. We show that U.S. firms’ probability of lobbying - and the total amount of lobbying expenditure - was related to these specific provisions that corporations were able to force into the agreement.

In our study, making use of an unprecedented shock to U.S. trade policies, we assess the impact of trade policies on firms’ expected profits and returns. We use information from the lobbying reports as firms’ revealed preferences over the TPP agreement – both at the extensive and intensive margin – and we find that, following the election of Donald Trump and the certainty of the non-ratification of the Trans-Pacific Partnership, firms that bet on the trade agreement displayed negative returns in the stock market.

References

Blanga-Gubbay, M., P. Conconi, and M. Parenti (2019). “Globalization for Sale,” mimeo.

Rodrik, D. (2018). “What Do Trade Agreements Really Do?” Journal of Economic Perspectives 23, 73-90.