by Julien Vercueil, CREE – INALCO (France)

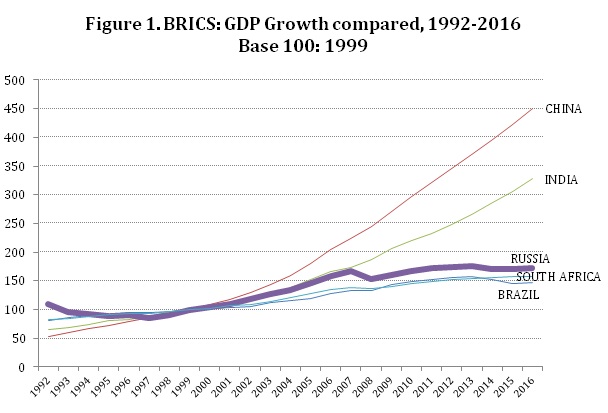

The use of the term of “emerging economies” has been much debated during the last couple of years. This is partly because it has been seen as a fuzzy concept, even if there have been some attempts to define it in economic terms with a satisfactory level of precision (Saccone, 2016 Vercueil, 2016); and partly, because it encompasses countries that, since the inception of the global financial crisis in 2008, are experiencing diverging trajectories, some of them (Russia and Brazil for instance, South Africa to a lesser extent) having registered practically no cumulative growth since the end of 2007 (Figure 1).

Data source: IMF World Economic Outlook Database, 2017Data source: IMF World Economic Outlook Database, 2017

In this brief note, rather than going deeper in the discussion of this term of emerging economies, we will focus on “emerging processes”. We define them as macro-economic transformations that, taken altogether in a given country, are sufficient to produce an economic trajectory that can qualify this country as an “emerging” one.

We will distinguish three main transformations:

• The first type of transformation is productivity growth. We use this term in its common sense (acceleration of value added produced per unit of time in a given country), but we add a qualification: in order to be considered as an emerging process, productivity growth must be higher than in advanced countries during a sufficient period of time. It seems that a period of 10 to 20 years can be considered as the adequate time horizon for this purpose: emerging processes take place in a mid-term horizon. This qualification is intended to maintain coherence with the “catching up” implication of the notion of “emerging economy”. If their duration is shorter than that, the transformations induced by growth are not deep enough to modify the structures of a given economy - and the simple word “growth” can easily replace “emergence” in order to describe correctly these changes. If, on the contrary, the period of rapid growth is much longer than a generation (lasting for instance between 30 and 40 years), the cumulative growth induced is such that, after such a long period, the country has almost closed the gap with the level of purchasing power that advanced economy enjoy. In those circumstances, “development” can replace “emergence” as the correct term to name these long-lasting transformations. Japan and South Korea are two examples of this process of development. They used to be emerging economies, but now they must be considered as developed economies.

• The second type of transformation implied by the term of “emerging processes” is economic opening, measured by usual statistical indicators (growth in exports, in capital inflows and outflows, economic openness ratios, etc.). These transformations mean that economic actors of these countries, at all levels, are building new, more intense economic relations with the rest of the world. Maintained during a long enough period of time, this acceleration of exchanges of knowledge, capital, goods and services deeply affects the structure of the national economy. Under certain conditions, it can also fuel the productivity growth already mentioned.

• The third type of transformation is institutional change. Of course, practically all countries are experiencing, to some extent, institutional changes. For these changes to be qualified as emerging processes, they must affect economic behaviours deeply, throughout the national territory. They open new possibilities for people and firms to undertake economic activities, they participate to the economic opening processes abovementioned, and they contribute to re-define the economic role of the State. The extent to which these change can be called “liberalization” is a matter of debate. Many institutional changes consist not only in removing existing “rules of the game”, but in replacing them by new ones. Dani Rodrik, Joseph Stiglitz and others (Serra and Stiglitz, 2008) show that debates about policies and institutional changes are constantly going on in developing and emerging countries are going on. But for them, there is no doubt that institutional change is a characteristic of the economic and social processes occurring in these countries.

• One particular field of these institutional transformations is concerning the relations with the rest of the world: in general, institutional transformations in these countries consist in giving more possibilities to interact more intensively with the outside world. Again, this economic opening is not necessarily maximal. There are plenty of possible ways to allow new exchanges to develop between resident and non-residents, including many restrictions and conditions. In fact, a lot of emerging economies are far for having opened completely their country to foreign companies and capital (Vercueil, 2015). But in all of them ond can find this kind of institutional transformations, allowing more international exchanges to take place. Hence, emerging economies are emerging actors in the world economy.

Applied to middle income economies (ranging from 10 to 75 % of PPA per capita GDP of advanced economies), these transformations are labelled “emerging processes” in this short note. One can assume that in order to benefit from a successful growth path in the medium term, an emerging economy must be able to foster a critical mass of emerging processes for a long enough period of time. However, there is no automatic link between a given set of institutional changes and productivity growth. Contrary to what have been repeatedly written during the “golden age” of the Washington consensus, there is no “one best way” for emerging economies. Rather, one can observe several possible economic trajectories that reflect the variety of “growth models” that can be sustained in the medium term. By analysing these trajectories, it is possible to decipher the co-evolution processes and the reciprocal influences that link institutional changes, short-term policies and economic outcomes. Far from systematically reinforcing the development path, in some cases these interactions can derive into an “institutional lock-in”, impairing the development of the growth regime and trapping the economy into a low-productivity, low-growth path that can sustain itself for a long period.

Rents can become engines of such an institutional lock-in. As they arise from the property and exploitation of an asset that is both abundant in the national territory and in high demand in the rest of the world, rents are not the outcome of the traditional competition process that we usually observe between economic actors. Their existence is neither dependent on previous profitability of the sector, nor has it much to do with the rhythm of investment and modernisation of the companies involved. For instance, rents coming from the property of raw materials consist mainly in royalties attributed to the owner, without requiring him to manage efficiently this wealth - he can easily delegate this task. Hence, the existence and the magnitude of rents is far less sensitive to the quality of asset management than to the relative prices of the raw materials on which it is based. Finally, from the institutional point of view, the development of rents can induce idiosyncratic institutional changes as it produces large income and wealth discrepancies between sectors and economic agents favoured by rents, on the one hand and manufacturing sectors on the other, dividing economy and society in segments weakly connected to each other, and impairing the diversification of activities.

A “rent-based growth model” is a macroeconomic mode of accumulation and redistribution of wealth that depends primarily on rents. This is not to say that in this growth model the rent-based sectors contribute to the major part of the value added of the country, but rather that for economic growth to be sustained over a mid-term period, it needs the continuous development of these rents. The rent-based growth model can be compared and contrasted with two other ideal-types of growth models that help to understand the trajectories of contemporary emerging economies: the “export-led growth model” - in which external trade and FDI play determinant a role in shaping both supply and demand -, and the “domestic demand-led growth model” - in which productivity growth are redistributed within the country, hence developing demand for domestic firms – (Vercueil, 2015). Similarly to the export-led growth model, the rent-based growth model is extraverted, since the bulk of rent revenues are extracted upon foreign consumers who are the end-users of the raw materials involved. But as in the “domestic demand-led growth model”, this growth model is supported by redistribution schemes that imply a specific role for the State.

In the recent past Russia has experienced the pro- (and, more importantly, the contra-) of such a rent-based growth model. In the Russian economy, oil prices exert a determinant influence not only on oil and gas companies, on the external trade balance and the current account, but also on the value of the national currency, the budget revenues and the fiscal balance and finally, depending on the fiscal and monetary policies pursued, on the purchasing power of Russian households (World Bank, 2016). At the same time, as can be seen in macroeconomic indicators, labour productivity in Russia follows closely the evolution of oil prices, as if variations of the value added in the oil and gas sectors were sufficient to explain the overall efficiency of the economy (Graph 2). Of course, this is not exactly the case, but value added in Russia is strongly influenced by world oil and gas prices, explaining the sensitiveness of macro productivity evolutions to them.

Source : Total Economy Database 2017, author’s elaboration. Source : Total Economy Database 2017, author’s elaboration.

Usually, when economists study the macroeconomic vulnerabilities associated with oil and gas dependence, they refer to the “Dutch Disease” model (Salter, 1957, Corden and Neary, 1982). This neoclassical model, which tries to capture the sectorial distortions created by a boom in the oil and gas industry in a partial equilibrium framework, focuses on resource displacement and real exchange rate effects, and therefore fails to capture the institutional dimension of the oil and gas dependency. As we have seen, when they are large enough, oil and gas rents can influence – and in some cases, determine - policies and institutions shaping, driving policy makers to pursue economic goals that may be focused on rent-based sector, to the detriment of the rest of the economy. For instance, pressures coming from the powerful rent-based sector may strongly influence fiscal policy, money creation and access to international capital markets. In Russia, by giving Government and Central Bank access to cheap money, oil and gas rents have distorted policies, further impairing the diversification of the whole economy. Furthermore, since rent distribution can calm – to a certain extent - grievances coming from the population, it tends to develop a paternalistic state, in which the fiscal burden is not supported mainly by the population, but in the end by world consumers of raw materials, who do not have a say in national policy making. On the domestic side, if the institutional framework is not strong enough to control abuses against state interests, rents tend to foster corruption. This is partly explained by the fact that, since the level of tax rates supported by citizens and enterprises is low – thanks to the contribution of rents to public budgets -, it can lower the level of engagement of taxpayers in public affairs. In this case, citizens’ reactions against abuses and misuses of public funds are too weak to induce the necessary institutional and policy changes. By ignoring such institutional processes induced by a boom in a rent-dominated sector, the Salter, Corden and Neary’s model fails to help us understanding why some countries fail to overcome the distortions associated with rent dependence, while others may succeed.

In Russia, the impact of rent on economic growth has been largely documented. To date, one of the most accurate accounts of this impact can be found in Kudrin and Gurvitch (2016). Thanks to the increase in oil and gas world prices during the period, the surplus oil and gas revenues grew rapidly. This surplus is closely correlated with economic growth. With an estimated elasticity of GDP to oil and gas prices of 0,2 to 0,3, diverse econometric works suggest that rents contributed to around 3 – 3,5 % of GDP growth each year in Russia. The authors estimate that rents have significantly contributed to economic growth. They also note that capital inflows, of which an significant part was channelled to oil and gas industry, have played a significant role in the economic growth since 2000 (Kudrin and Gurvitch, 2016, p. 34).

Policies designed to reap the benefits of the rents have been various. One of the most significant was the exchange regime and exchange rate policy that associated the liberalization of the capital account in 2006 with a de facto commitment to a fixed peg of the rouble. By these two decisions, policymakers intended to bolster inward foreign investments and therefore to contribute to the modernisation of the stock of capital in the country: as the exchange rate risk was considered as fairly low, international investors would raise their level of confidence in the rouble and start to invest heavily in the Russian currency. Another explanation for this policy is the heavy lobbying exerted by oil and gas companies and the banking system: a stable exchange rate allowed them to borrow in foreign currencies (mainly in dollars and euros), hence lowering the cost of credit for oil and gas companies and allowing banks to benefit from a high differential between the interest rate associated with their resources and the interest rates applied to credits that they granted to their (mainly Russian) borrowers.

However, the liberalization of the capital account opened the possibility of a sudden withdrawal of capital in case of increased uncertainty. Hence the liberal stance adopted as regards rouble convertibility appears as a kind of double-sided sword in that it increased the potential consequences of a reversal of risk appetite in world capital markets. This happened twice since 2007: firstly, during the international financial crisis of 2008-2009; secondly, during the beginning of the Ukrainian crisis, in 2014-2015. For the Russian economy, things were worsened during these two episodes by the sudden drop of oil prices that contributed to decrease the inflows of foreign currency and put the rouble under pressure, leading to speculations against its de facto pegged exchange rate.

To summarize this note, when one tries to disentangle the various effects of a rent-based growth regime, it is necessary to distinguish between short term and long-term consequences. In the short term, rent dependence increases the vulnerability of the economy to a sudden drop of oil prices and capital inflows. Such a drop could induce not only a big stress on oil and gas companies that may be subject to exchange rate risk by they borrowing policy. It could also have a strong effect on public budgets, especially if fiscal discipline has been weak during the previous period. Finally, the short-term effects of a reversal in price trends can be of a monetary character, as it can jeopardize the stability of the exchange rate, especially when domestic capital markets are widely open, relatively narrow and prompt to speculative activities.

In the long run, the consequences of an excessive dependency on oil and gas rents are not only the growing difficulties of a number of manufacturing sectors that can lead to a de-industrialization process. It is also the development of an institutional lock-in where concentrated economic and political powers become dependent from the rent-based sector and therefore develop institutions and policies that favour it to the detriment of tradable sectors. This institutional lock in can be strong enough to impair any attempt to diversify political and economic supplies, as long as the domination of the rent-based sector is not subverted by a crisis.

References :

Corden M., Neary J. P. (1982) : "Booming Sector and De-industrialization in Small Open Economy", The Economic Journal, N°92, pp. 825-848.

Kudrin A., Gurvich E. (2015) : « A new Growth Model for the Russian Economy », Russian Journal of Economics, 1 (2015), p. 30-54.

Rodrik D. (2008) : « A practical approach to formulating growth strategies », in Serra and Stiglitz (2008), p. 356-366.

Salter W. (1957) : "Internal and External Balance : the Role of Price and Expenditure Effects", in Economic Record, N°35, p. 226-238.

Saccone D. (2016) : “Emerging Economies in Comparison to the rest of the world”, Emerging Economies, N°4, November 2016.

Serra N., Stiglitz J. (Eds) (2008) : The Washington consensus reconsidered. Toward a New Global Governance. Oxford: Oxford University Press.

Vercueil (2010:2015) : Les pays émergents. Brésil-Russie-Inde-Chine : mutations économiques, crises et nouveaux défis. Paris : Bréal, 2015 (first edition 2010).

Vercueil (2016) : “Emerging Economies. Genealogy, Evolutions and Vulnerabilities”, Emerging Economies, N°4, November 2016.

World Bank (2016) : Russian Economic Report, n°36, November 2016.